How long should it take to sell a home? Does the passage of time cause the home to look unattractive and stale? Is there any advantage to it taking longer to sell a home? Should it be priced perfectly and sold in a week to get the best price? Right now I am selling oneContinueContinue reading “Time and Its Effects on Home Sales”

Tag Archives: investing

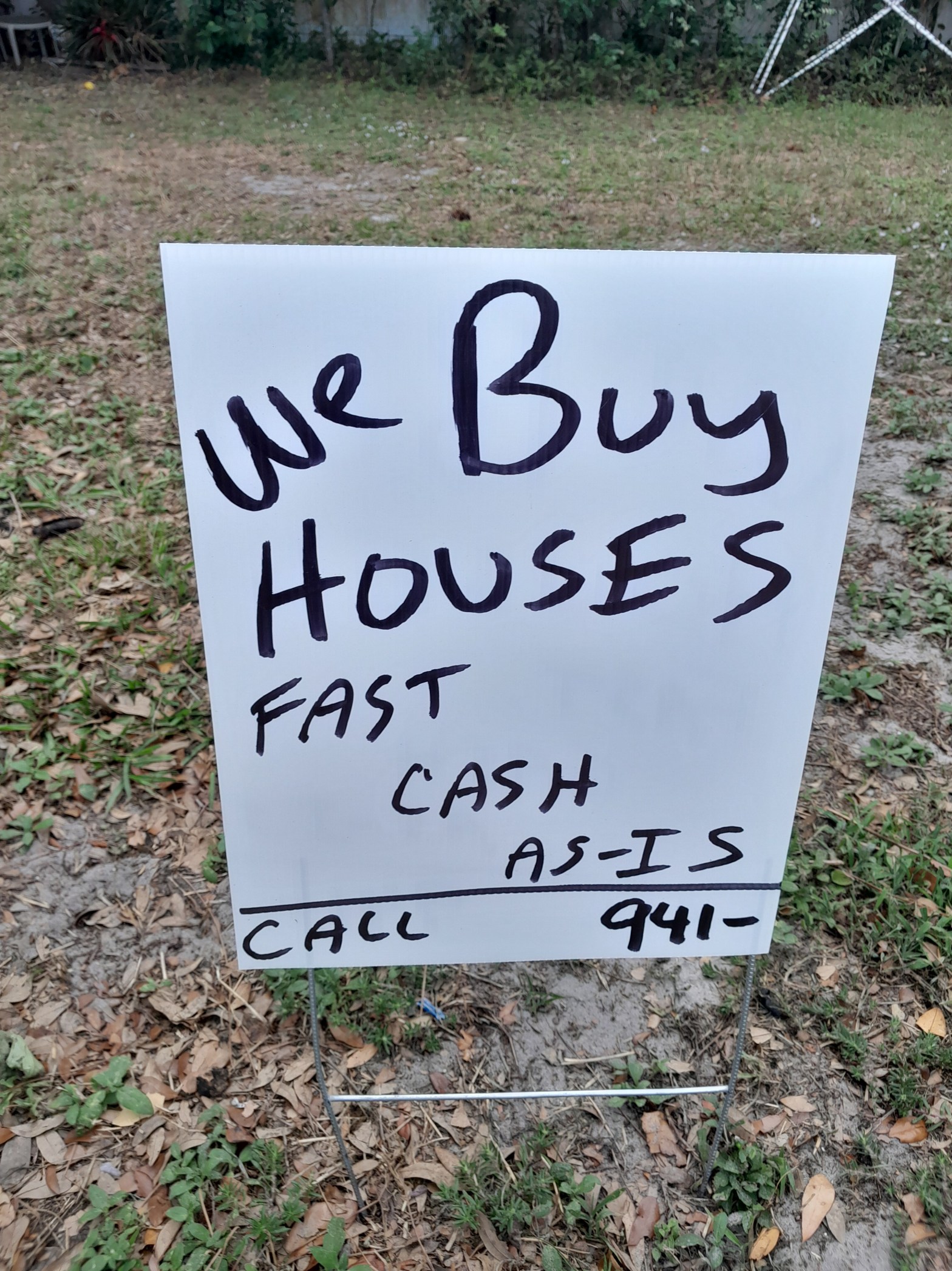

Watch out for the wrong buyer!

After representing hundreds of home sellers, I inevitably encounter thousands of the wrong buyers. They are the type of people that make their money by taking advantage of others. They have no guilt or shame in running off with another person’s life savings. They have no remorse about dragging the seller through 6 months ofContinueContinue reading “Watch out for the wrong buyer!”

How Not to sell your Sarasota Home

“We Buy Houses for Fast Cash.”

“Selling Your Home Fast Just Got Easy”

calling Prime Time Real Estate to sell their home

Prime Time Real Estate of Florida secured a buyer for 31% more than the neighbor had offered.

The truth is that Prime Time Real Estate Inc of Sarasota makes home selling easier and more profitable.

How Tenants Affect a Real Estate Sale

In Sarasota real estate sales involving rental properties, landlords face challenges when tenants are still occupying the home. While some sellers opt to sell with tenants in place, tenant cooperation for showings is often problematic. Ultimately, it is generally preferable for homes to be vacant before selling, or incentivizing tenant cooperation may be necessary.

New Realtor Contract Rules: What Buyers Need to Know

In August 2024, a realtor network settled for $418 million without admitting guilt. Consequently, realtors must secure signed contracts with buyers before showings. Buyers may need to cover their agent’s commission if sellers don’t pay. Buyers can sign with multiple agents, but doing so for the same property can lead to double commissions.

What happened to Realtors on August 17th, 2024

On August 17th, 2024 The Realtor network has exercised the power to change procedure in attempt to prevent costly 418 Million dollar lost lawsuits.

Maximize Wealth with a 1031 Exchange

Inherited properties can enhance wealth, and a 1031 exchange allows selling such properties to acquire “like-kind” investments while deferring taxes. This option requires adherence to strict timelines and IRS regulations, including involving a qualified intermediary. Utilizing a 1031 exchange can effectively facilitate portfolio growth and tax efficiency in real estate investments.